Brittany Gautreau seen in August Edition of Riviera Magazine!

Submitted by Clarity Capital Partners on August 11th, 2015

Each type of investment has specific strengths and weaknesses that enable it to play a specific role in your overall investing strategy. Some investments may offer growth potential. Others may provide regular income or relative safety, or simply serve as a temporary place to park your money. And some investments may even serve to fill more than one role.

Your employer-sponsored retirement savings plan is a convenient way to help you accumulate money for retirement. Using payroll deductions, you invest for the future automatically, following that oft-noted advice to "pay yourself first." But choosing to participate is just one important step. Another key to making it work for you is managing risk in your portfolio.

There's a saying that with age comes wisdom, but this may not always be true in the financial world. As people move through different life stages, there are new opportunities--and potential pitfalls--around every corner.

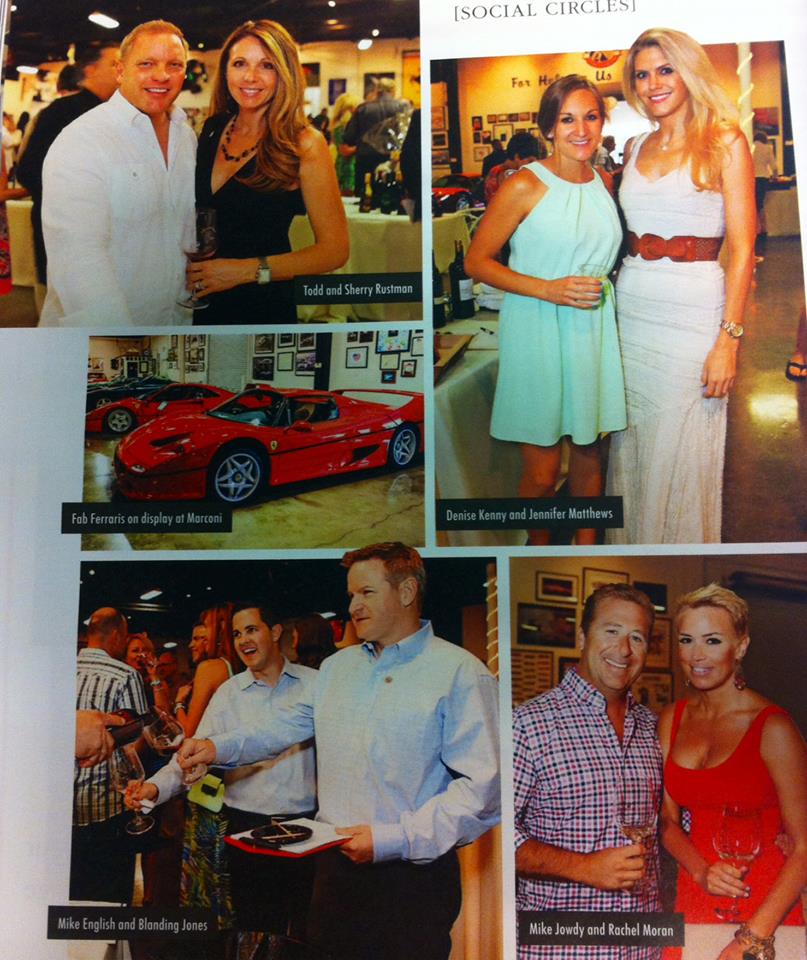

Our Managing Partner, Todd Rustman, was recently featured in Riviera Magazine for his time at the "Sunday in the Vineyard" event, held at the Marconi Automotive Museum. This great event benefitted at risk children in the OC area.

For many affluent families, the best option to keep their family wealth for generations is to create a "Family Office" that manages all things money. The Multi-Family Office platform that Clarity Capital Partners offers gives the freedom and peace of a Family Office to those who desire to do the same for their own assets (from $25-$200 million).

We are excited to announce our new tool to keep your financial life in one place. Think of it as your one stop shop to your financial today and tomorow. To explain a little better how our eMoney tool will help you keep track of things, give our video below a watch:

Here at Clarity, we are glad to serve our clients within the Multi Family Office model. However, many people are curious what exactly a MFO is. The article below, care of FamilyOffice.com, helps explain what we do: