5 Tips for Navigating the Coronavirus Crash

Submitted by Clarity Capital Partners on April 8th, 2020

When stock markets experience sudden downturns, investors can feel anxious and make decisions detrimental to their long-term goals. After all, when you’ve worked hard for the money, it’s painful to see your account balances drop. This is a natural reaction, even with savvy investors who’ve experienced market volatility before. These extremes are enough to test your nerves.

Now is not the time to panic and change your investment strategy. This is the time to stay level-headed, maintain perspective, and focus on the long-term. We recommend the following five strategies to help you navigate this challenging time:

1. Remember the “pot of gold.”

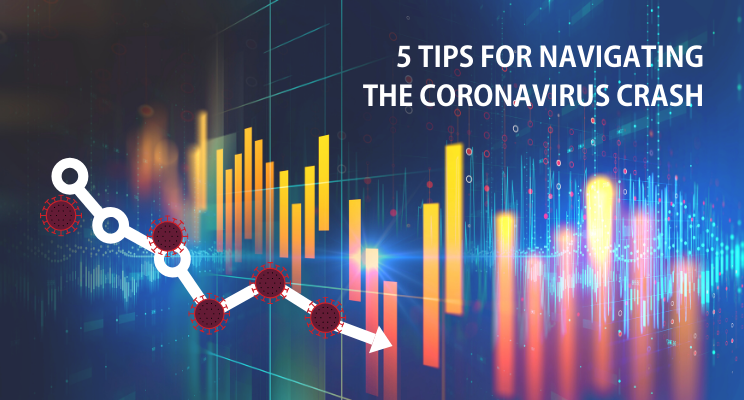

Downturns are not rare events and statistics favor staying the course. The data below speaks volumes, showing in the year following the trough (low point) of a bear market, the returns were on average 47%. This is the “pot of gold” waiting for you at the end of this inverted rainbow.

2. “Unfriend” the financial news.

When the markets are volatile, the news cycles never end. To be clear, you do want to be knowledgeable about what’s happening in your portfolio, but you don’t want to overdo it. You don’t need hour-by-hour updates on your investments any more than you need hour-by-hour updates on your favorite sports team. Watching more closely doesn’t improve the results.

Consider limiting the financial information you receive by social media, TV, and newspapers. Regardless of the medium, they thrive on negativity and these bits of information have a cumulative effect. The more you absorb it, the more you risk anxiety, fear, and even panic. As any good financial advisor will tell you, panic leads to more losses than volatility.

3. Leverage your “financial foursome” in times of stress.

Investing in the stock market involves risk. We all know that going in, but it’s only truly tested when the markets become volatile. It’s normal to feel anxious, concerned, worried, or even fearful. This is precisely why you want to work closely with your “financial foursome,” which includes your CPA, your estate attorney, your mortgage broker, and your financial advisor.

Each of these professionals provides a different perspective, not only for capitalizing on opportunities but also for keeping yourself level-headed. If your “financial foursome” is lacking in some area, leverage your financial advisor for recommendations. They are likely well-connected to the best providers in the area.

4. Take your investment strategy from “vapor to paper.”

If you want to stay on track with your investments, regardless of what the markets are doing, you should commit them to writing. An Investment Policy Statement (IPS) is a document drafted between you and your financial advisor that outlines general rules for meeting your investment objectives. It includes criteria for monitoring performance, addressing risk, and communication between you and your advisor. Your IPS should also include a provision explaining when you should rebalance your portfolio. Without written objectives and guidelines, your investments are subject to the whims of your emotions, and how you “feel” you should be investing.

5. Re-assess your “financial pain tolerance.”

You probably took a risk tolerance questionnaire with your advisor years ago and maybe long forgot about it. Now is a great time to go through this exercise again. You’re older now, your life has changed, and your risk/pain tolerance likely has as well.

Many factors contribute to individual risk tolerance, including age and short- and long-term financial goals. Volatility can present the perfect opportunity to rebalance. Work together with your advisor to find the ideal balance of investments to suit your comfort level.

Final Thoughts

Remember, now is a moment to be cautious, not a moment to panic. If you’ve worked hard with your financial advisor to create a financial plan, stick with it. Historically, recoveries have rewarded patience. If you’re thinking about timing the market, remember that knowing when to get out is only half the battle; you also need to know when to get back in. Staying invested for the long term is far more likely to yield a favorable outcome.

If you’re concerned about recent volatility and have not heard from your current advisor, contact us to schedule a complimentary second opinion. We can review your current investment strategy, portfolio, risk tolerance, and Investment Policy Statement and decide if any changes are necessary. We’re here to help.

References

Tools for Navigating the Coronavirus downturn

5 Investing Do's and Don'ts To Deal With Stock Market Volatility

By Lynnette Khalfani-Cox - https://www.ebony.com/career-finance/5-investing-dos-and-donts-to-deal-with-stock-market-volatility/

Before You Get Out of the Stock Market, Read This

Please remember to contact Clarity Capital Partners if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request. The information contained in this e-mail message is intended only for the personal and confidential use of the recipient(s) named above. If the reader of this message is not the intended recipient or an agent responsible for delivering it to the intended recipient, you are hereby notified that you have received this document in error and that any review, dissemination, distribution, or copying of this message is strictly prohibited. If you have received this communication in error, please notify us immediately by e-mail, and delete the original message.

Investment advisory services offered through Clarity Capital Partners LLC, a registered investment advisor. Securities offered through West Park Capital, Inc. Member of FINRA/SIPC. Clarity Capital Partners LLC is not affiliated with West Park Capital, Inc.